The reasons why we are the best route for obtaining an SBA loan.

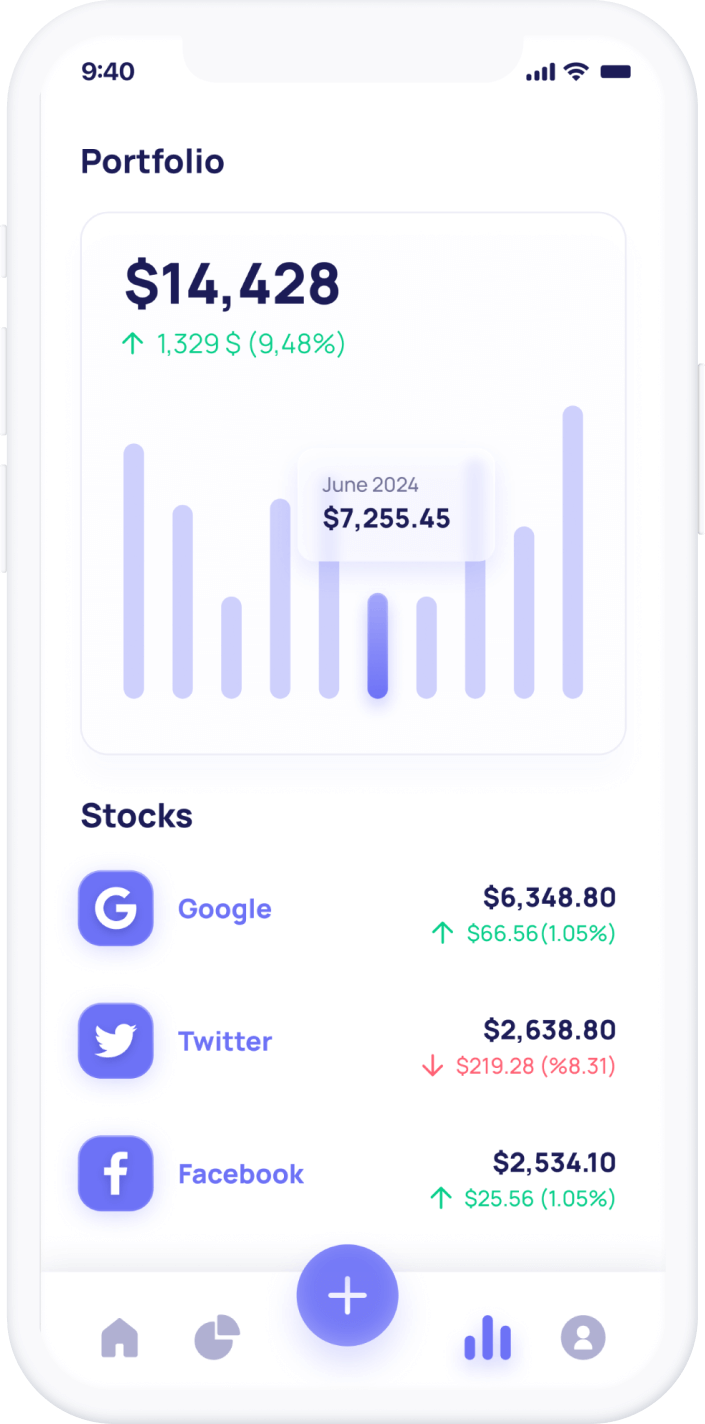

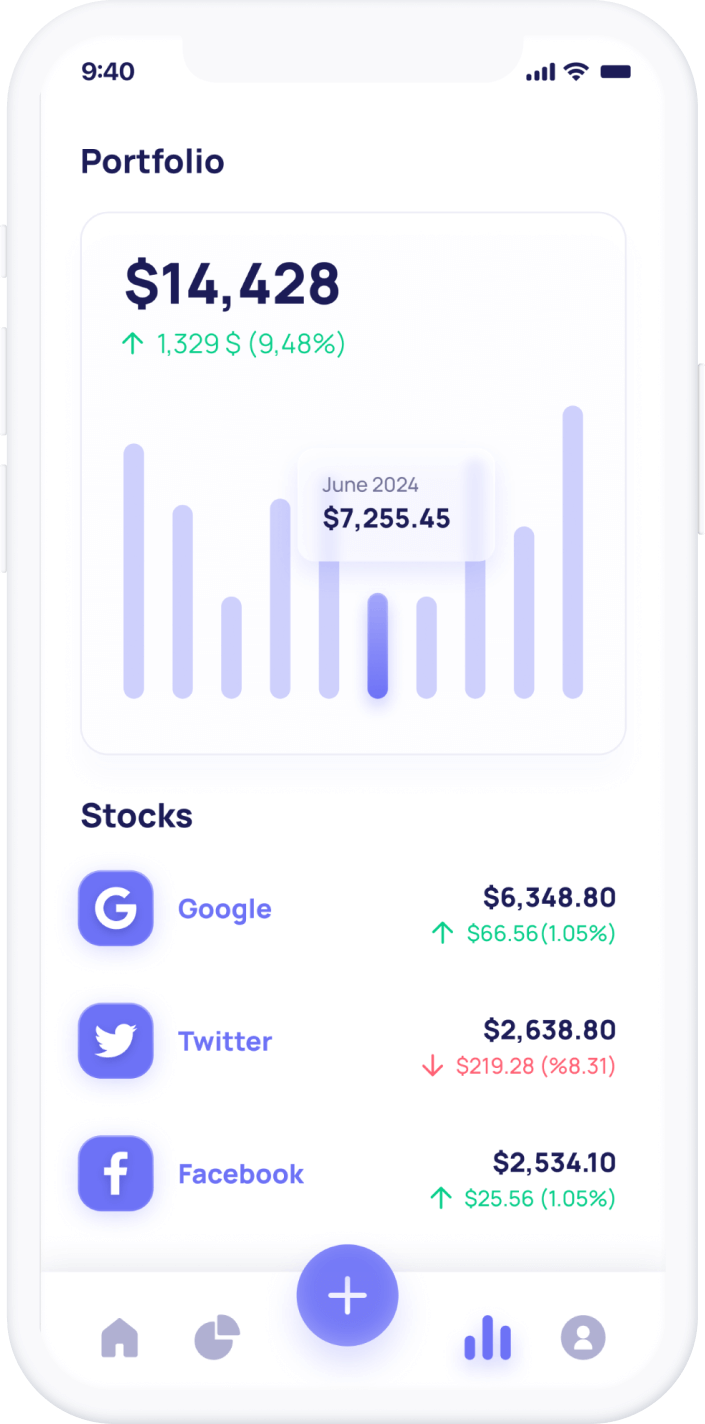

Versatile Loan Options

SBA loans are specifically engineered to support business growth. So whether you’re looking to buy equipment, acquire real estate or address business working capital needs, the SBA’s mission is to help expand American Small Businesses.

Rapid Capital Access to SBA Loans

Since SBA loans are guaranteed by the federal government, banks are confident to lend to SBA approved businesses that would otherwise be declined for conventional bank credit. This makes for a simpler funding process, eliminating the usual underwriting obstacles.

Attractive Terms

Our SBA lenders offer extended repayment timelines along with competitive low-interest rates. The SBA loans we offer are definitively the more advantageous option compared to other small business lending choices.

Prior to diving into a full SBA application submission, the team at Fastway SBA provides each prospective applicant an overview of what is possible, based on key qualifying characteristics of your business. We use these benchmarks to understand your business’s unique pre-approval:

“Fantastic...”

Working with Fastway SBA was fantastic. I wish I knew I could have been approved sooner, instead of taking more expensive business funding. Thanks for getting my business back on track! Great experience, would recommend to all business owners

“Funded within a couple weeks...”

My rep John helped me get pre-approved, submitted and funded within a couple weeks. When I was initially exploring an SBA loan I was under the impression it was harder to get approved. Thanks to John and the team to make the document collection and funding a smooth process. Thanks for the help.

FASTWAY SBA

The Express Route to SBA Funding

Fastway SBA is a trusted lending partner for SBA loans. Our Mission is to Empower and Grow Small Businesses by providing fast and affordable financing. With SBA Loans, borrowers can receive up to $5 million with repayment terms of up to 25 years. These loans are attractive to small businesses due to their affordable cost and long term structure. Funds can be used for various small business purposes, including working capital, equipment, and real estate.

.png)